The ESG (Environmental, Social, and Governance) investment market has been experiencing significant growth and gaining traction in recent years.

Several sources and studies provide insights into the current size of the market and its potential for future growth.

According to a survey conducted by Domini Impact Investments, 8 out of 10 investors express interest in adding ESG investments to their portfolios. Millennials, in particular, show a strong inclination towards ESG investing, with a 93% likelihood of investing in this area. Additionally, 50% of the participants in the survey stated that they would be willing to prioritize sustainable development goals over investment performance. However, given the stable growth indicators, sacrificing investment performance may not be necessary.

Source: Domini Impact Investing Survey

Another report by Adam Green on Forbes highlights the increasing importance of ESG investing. The report indicates that climate change is one of the most significant challenges of this decade, driving the demand for ESG investments. ESG funds have doubled from 2020 to 2021. Furthermore, ESG funds demonstrate higher longevity in the market, with a 77% likelihood of surviving for periods longer than 10 years, compared to 46% for traditional funds.

Source: The Future of ESG Investing

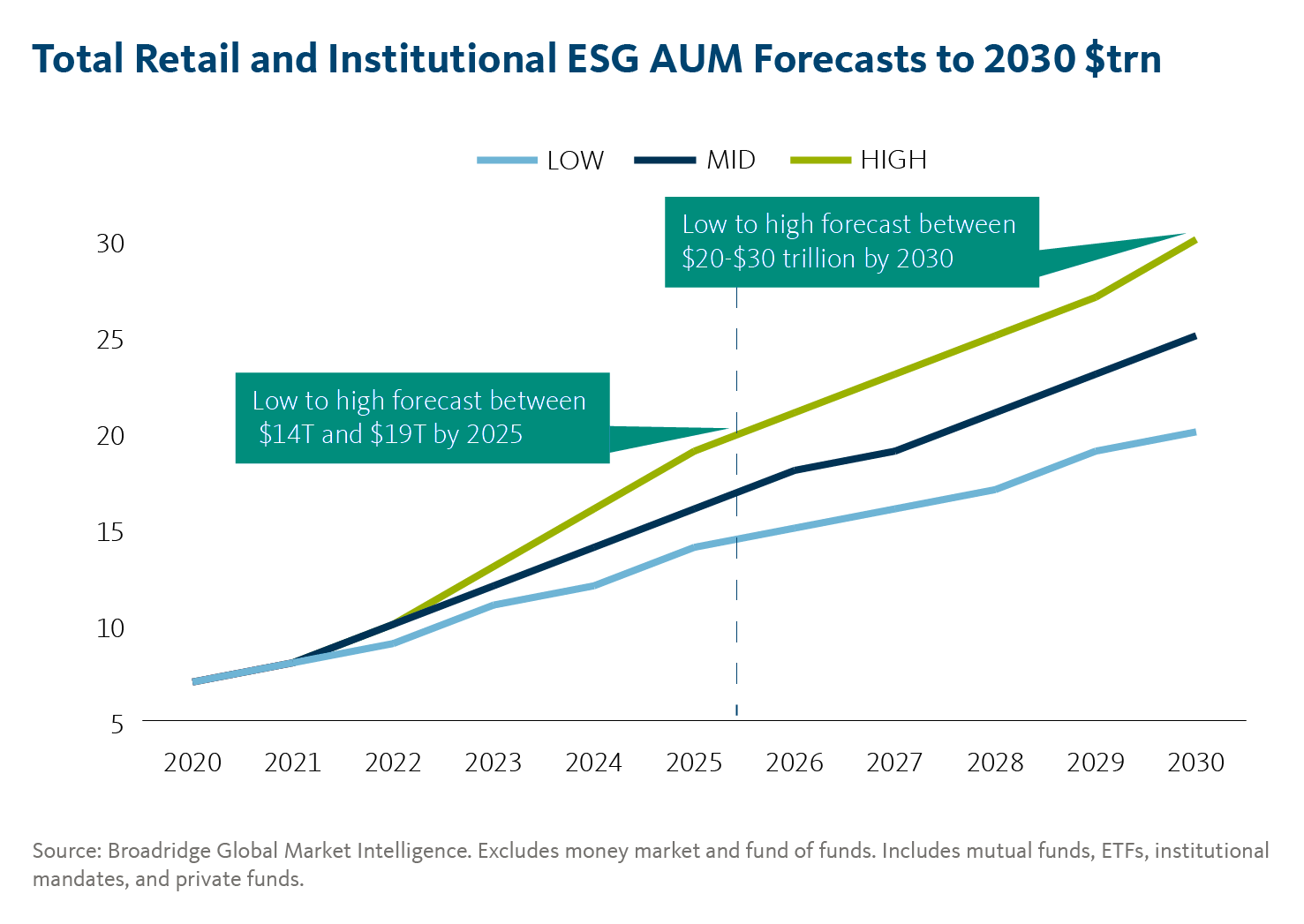

Research conducted by Broadridge indicates that ESG mutual funds, ETFs, institutional mandates, and private funds are projected to grow from $8 trillion to $30 trillion by the end of this decade. Bloomberg forecasts that ESG assets will reach $50 trillion by 2025. Despite the economic challenges posed by the COVID-19 pandemic, investors recognize the potential of the ESG market and the positive impact of sustainable investments on the environment.

Broadridge Global Market Intelligence further reveals that Europe has seen a significant influx of ESG investments, with more than 100% of the ESG flow and 62% of the international market flow. Thematic equity funds have experienced a surge in net inflows, with 65% of the $303 billion directed towards ESG products in 2021, representing a tenfold increase compared to 2019.

Based on the aforementioned research and data, ESG practices have become a crucial factor for investors when analyzing potential investments. ESG considerations are no longer optional but integral to investment decision-making. This shift in investment culture signifies a fundamental change where circular bio-economy is no longer a trend but a vital aspect of every serious business.

Sources: